-

play_arrow

play_arrow

Kl 1 Radio Local radio for west Norfolk

-

play_arrow

play_arrow

KL DISCO KL Disco Playing Disco Music from the 70's onwards.24/7

-

play_arrow

play_arrow

KL COUNTRY KL COUNTRY Playing New and Classic Country Music 24/7

-

play_arrow

play_arrow

KL ROX KL ROX The best of New and Classic Rock.24/7

-

play_arrow

play_arrow

KL SUMMER Summer Vibes 24/7 from KL1 Radio across West Norfolk

-

play_arrow

play_arrow

KL CLASSICAL Your Symphony Starts Here

-

play_arrow

play_arrow

KL CHILL Just Chill!

-

play_arrow

play_arrow

KL POP The Best POP Hits all day Long!

-

play_arrow

play_arrow

KL XTRA KL XTRA

music_note

![]()

The average homeowner on a tracker mortgage will see their monthly repayments fall by nearly £29, after the quarter-point snip to the Bank of England base rate.

UK Finance said homeowners on tracker deals will typically see their monthly repayments reduce by £28.97, based on balances outstanding. This could add up to a saving of nearly £350 over the course of a year.

People on a standard variable rate (SVR) mortgage could see their monthly payments fall by £13.87, assuming that their lender passes on the base rate cut in full, which could add up to a saving of nearly £170 over a year.

Mortgage holders may end up on an SVR when their initial deal ends and the rate is set by individual lenders.

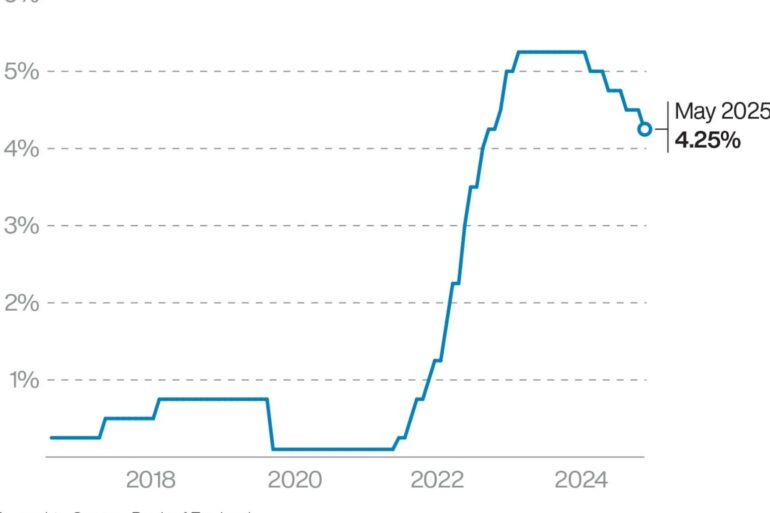

The Bank of England cut the base rate to 4.25% on Thursday, from 4.5%, following a slowdown in inflation in recent months.

Many lenders have been chopping rates in recent weeks, including several offering deals at sub-4% levels.

Around 85% of outstanding mortgages are fixed rates – and homeowners on these deals will not see their rates change until they move onto a new deal.

According to UK Finance’s figures, 1.6 million fixed-rate mortgage deals are due to end, or have already ended, at some point in 2025.

Rachel Springall, a finance expert at Moneyfactscompare.co.uk, said: “The driving force behind the recent falls (in mortgage rates) has been volatility in swap rates, with lenders rushing to pass on cuts to fixed rates in their range.

“This momentum has led to the average two-year fixed rate dropping to its lowest point since September 2022.”

Ms Springall said this was just before “the notorious fiscal announcement, or ‘mini-budget’, that saw markets panic and mortgage rates skyrocket”.

She added: “The mortgage market is undoubtedly calmer now by comparison, despite a rush to reprice fixed deals, but lenders are going to have to work incredibly hard in the coming months to balance new business and keep a close eye on their rate margins.”

The average two-year fixed-rate mortgage on the market at the start of May was 5.18%, while the average five-year fix was 5.10% and the average SVR was 7.58%, according to figures from Moneyfactscompare.co.uk.

Ms Springall said: “Those borrowers coming off a cheap fixed rate would be wise to refinance or risk seeing their monthly repayments soar by falling onto a higher ‘revert rate’.

“Despite consecutive falls to the average standard variable rate (SVR), the incentive to switch remains.”

Ms Springall added: “There is an expectation that the Bank of England base rate will be cut several times before the year is over, due to wider economic uncertainty and concerns over inflation.

“Those borrowers concerned about their homeownership aspirations will need support and innovation from lenders. First-time buyers are the lifeblood of the mortgage market, and they are essential to keep the market moving.”

The rate cut could help to inject more buyer interest into the housing market, following the recent ending of a stamp duty holiday.

The Royal Institution of Chartered Surveyors (Rics) said on Thursday that home buyer inquiries and sales fell in April.

But figures released by Halifax on Thursday indicated that house prices are continuing an upwards march.

It recorded a 0.3% month-on-month price rise in April, following a 0.5% monthly fall in March.

The annual house price growth rate ticked up to 3.2% in April, from 2.9% in March.

The average property price in April was £297,781, up from £296,899 in March, according to Halifax.

Richard Donnell, executive director at Zoopla, said: “Today’s base rate cut is welcome news for people looking to sell and buy homes in 2025.

“It will provide a boost to market sentiment and filter slowly into lower mortgage rates as the cost of fixed-rate mortgages already reflects future cuts in the base rate.

“This, alongside reforms to mortgage regulations announced recently, will help boost buying power. This is important at a time when there is a large number of homes for sale across the UK – the average agent has 34 homes for sale. Improved buyer confidence will support sales and help more people realise their moving ambitions in the year ahead.”

Mark Manning, managing director of Northern Estate Agencies Group, said: “Today’s decision to reduce interest rates is fantastic news for the housing market and will help to strengthen buyer confidence and stimulate market activity.”

Meanwhile, some savers need to get their skates on before savings rates tumble further.

Ms Springall said that a year ago, the average easy access savings rate was 3.11%, but by the start of May this year it had fallen to 2.79%.

The average easy access Isa rate at the start of May 2025 was 3.03%, down from 3.33% in May 2024.

Ms Springall added: “There are several challenger banks and building societies offering decent inflation-busting returns on some of the most flexible easy access accounts, but savers just need to carefully check the terms of these accounts before they invest, such as those with withdrawal restrictions.”

Published: by Radio NewsHub

Similar posts

Upcoming shows

Nathan Barton – The Cut

8:00 pm - 11:00 pm

Night Trax

1:00 am - 7:00 am

Paul Baker – KL1 Breakfast

7:00 am - 10:00 am

Chris Fisher – KL1 Mornings

10:00 am - 1:00 pm

Chris Osler – Friday Afternoon Show

1:00 pm - 4:00 pm

-

Tracker mortgage holders could save nearly 350 a year following rate cut

Barry Keoghan visited Ringo Starr to study him for upcoming Beatles biopics

David Beckham and Gary Neville part of new ownership group at Salford

Bank cuts interest rates to 425 as tariff tensions dampen growth

Live Music – Man The Lifeboats

Message Us

Copyright The Mediasite UK - 2025